Don’t be afraid! You don’t have to navigate insurance alone this year.

Schedule your appointment today so we can help you with your enrollment.

Let’s Set a Date

EVERYONE needs to schedule a phone call appointment to re-enroll for 2018 coverage.

The Only Exceptions:

- Medicare Supplement plan holders

- Individuals with grandfathered plans

- If you have coverage through your employer

THE countdown HAS BEGUN!

We aren’t just counting down to Halloween! Our office is gearing up for the 2018 Open Enrollment season and we need you to get ready as well!

Choosing the wrong insurance plan can haunt you. Let us help you choose the best policy for your needs.

WHAT’S changing in 2018:

Humana is discontinuing their individual plans for 2018. If you are currently enrolled with Humana we will help you choose a new insurance company during our phone call.

BE prepared! (MUAHAHA)

Here are a few things we will need you to have prepared for our phone call:

- 2018 estimated household income. Make sure to include every person that is on your tax return.

- Who will you claim on your 2018 tax return?

- Married? As a reminder, you must file a joint tax return with your spouse.

- Does your employer or spouse’s employer offer group health insurance? If so, what is the cost for the employee only coverage?

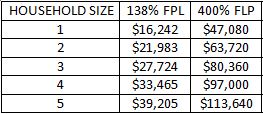

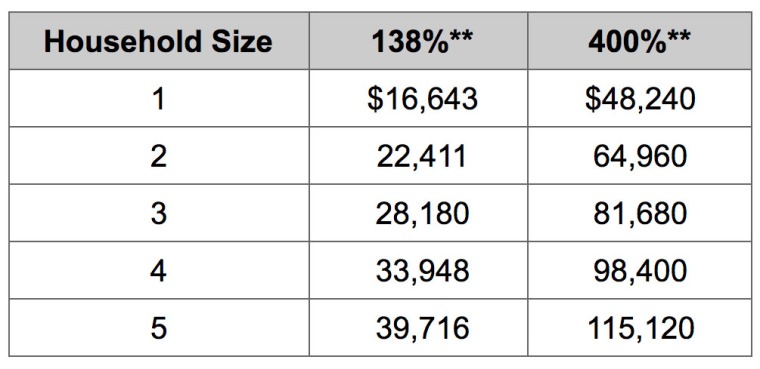

- Does your income fall between 138% and 400% of the FPL according to your tax size household?

D O N ‘ T . G E T . S P O O K E D !

Our time frame is super short this year, so we are setting appointments NOW. We have between NOVEMBER 1st and DECEMBER 15th to make changes that will go into effect JANUARY 1st.

Please click the link below or call our offices to schedule your appointment TODAY!

Appointments will be scheduled every 30 minutes so we’ve got to talk fast and make a decision quick. Being prepared is a MUST this year!

We are happy and honored that you continue to choose us as your insurance broker. We strive to give you the best possible service before, during and after the enrollment. We love our clients and hope to make this enrollment season super easy for you.

Please show us plenty of grace and mercy as we help you, our valued clients, with this nearly impossible task of re-enrolling over 1,000 clients in 6 weeks. Have you done the math? Yeah… that’s 45 clients per day including Saturday and Sunday. Oh my…

We Love Our Clients!

SCHEDULE NOW

Trish & Tori Freeman, The Insurance Lady

(225) 622-6554

Blue Cross and Blue Shield of Louisiana and HMO Louisiana members can use the code

Blue Cross and Blue Shield of Louisiana and HMO Louisiana members can use the code

Blue Cross and Blue Shield of Louisiana has joined all Blue plans around the country in offering free identity protection services to their customers.

Blue Cross and Blue Shield of Louisiana has joined all Blue plans around the country in offering free identity protection services to their customers.